The safeguarding of customer payment data has become crucial to building client trust and avoiding data breaches in the current digital ecosystem. The Payment Card Industry Data Security Standard is an internationally recognised framework designed to protect the information of the cardholder across every industry. In the Canadian business landscape, regulatory complaints are not a strategic practice; however, they are an unavoidable activity, regardless of a company’s size or transaction volume. From online retailers to regional service providers, every organisation in Canada that makes card payments needs to adhere to PCI DSS.

What is PCI DSS compliance in Canada?

Enquiry FormIn Canada, PCI DSS certification demonstrates the safeguarding of payment card transactions and the protection of card details across various financial transactions. The Payment Card Industry Data Security Standard helps organisations store, process, and transmit data securely. It facilitates the comprehensive implementation of consistency in data security measures, where service providers are required to adhere to the PCI DSS protocols. The primary objective of PCI compliance is to minimise the likelihood of cyber threats. The objective involves optimising a safeguarded card data environment, and it applies to any type of business landscape. Like the universal applicability of PCI DSS, the standard has been adopted by small hotels and stores, as well as e-commerce startups in Canada, and by multinational enterprises. Regulatory compliance is not restricted by regional landscape, industry, or transaction volume, but rather by the establishment of a consistent global standard. PCI DSS helps maintain data security across businesses, merchant service providers, and financial institutions.

PCI DSS compliance requirements in Canada

Twelve core principles of the PCI DSS Framework establish an extensive security pathway for Canadian businesses to follow, protecting payment card data and aligning with industry regulations.

● Firewall optimisation and maintenance – Firewalls are vital ways of securing networks as they continuously monitor and control network traffic based on security protocols, establishing a restrictive shield between the secure Internet and an unauthorised external network. Therefore, it is essential for optimising and maintaining fireworks so that it can restrict any kind of unauthorised accessibility to the service provider network, protecting the data of the cardholder.

● Proper password security – The first strategy optimised to protect sensitive information is password management. Therefore, it is essential to implement strong and unpredictable password policies that include complicated password systems, changing passwords regularly, and not using any vendor-supplied default for the system password or any other security factors.

● Protecting cardholder data – The core principle of PCI DSS compliance is to protect cardholders’ data. Even if consumers no longer use cardholder data, this service provider still stores it securely and implements strategic access control measures to prevent unauthorised intrusion.

● Encryption of transmitted cardholder data – After the transmission of cardholder data to the open network, it becomes susceptible to interception. Therefore, it is essential to optimise strong encryption methods so that sensitive information can be protected during transmission. The security system should ensure that even after the intersection of the data, it cannot be deduced without a proper decryption method.

● Utilising data protection software – To protect cardholder data, both antivirus and anti-malware software are essential to install, allowing for the detection of any malicious activity. To achieve PCI DSS compliance, the software suggestions help protect systems from threats that could compromise cardholder data and disrupt business operations. It is always crucial to keep security protocols up to date so that the service provider can mitigate any sudden risks.

● Properly upgraded software – To maintain a secure data environment, software must be updated and compliant with the latest PCI DSS protocols. With regular software updates, it can help protect against threats and maintain client integrity.

● Restricting data accessibility – It is essential to limit access to cardholder data. This means that people who require data accessibility to perform their regular job should have access to data, not service providers. The implementation of strict access control measures can efficiently minimise the risk of unauthorised accessibility to confidential information.

● Unique IDs assigned to data accessibility – A unique ID would serve as a verification code for every person with access to cardholder data. This will enable us to track and monitor individual access to data, identifying any unauthorised intrusion or malicious activity.

● Restricting physical accessibility – It is mandatory to maintain both physical and digital security to protect cardholder data, as this can also be responsible for authorised accessibility and data manipulation.

● Creating and monitoring access logs – To identify and respond to security incidents appropriately, it is essential to have both monetary and checking login access to network resources for the cardholder. Daily monitoring of access logs helps service providers identify malicious activity and prevent significant data breaches.

● Testing the security system – It is crucial to identify significant volatilities and implement efficient mitigation strategies for regular optimisation of the security system and processes. Regular optimisation includes firewall assessment, detecting illegal intrusion, and implementing necessary security measures.

PCI DSS merchant level-wise requirements

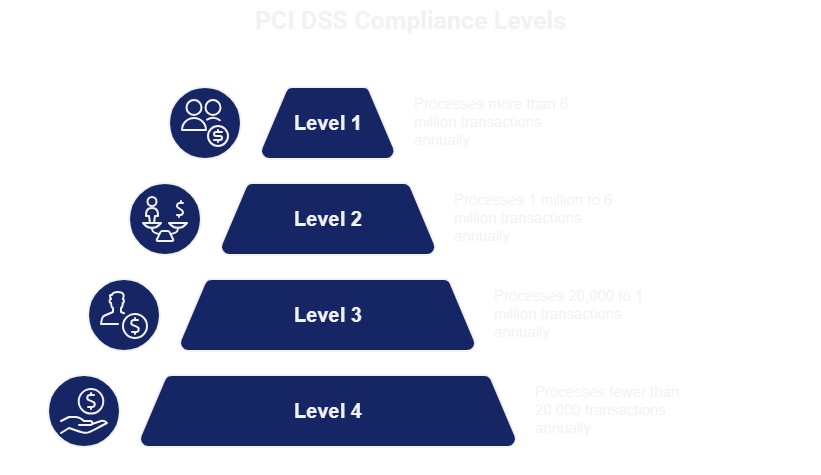

In Canada, all service providers and merchants that store, transmit, and process credit card data must adhere to the PCI DSS. The primary objective of PCI DSS is to minimise credit card fraud and enhance data protection. There are four essential PCI DSS compliance levels for merchants, based on the volume of card transactions that the service provider processes each year.

Level 1: Companies that process more than 6 million card transactions annually

Level 2: Companies that process between 1 million and 6 million card transactions every year

Level 3: Enterprises that process between 20000 and 1 million card transactions every year

Level 4: Business is a process that processes fewer than 20000 card transactions every year

Steps to achieve PCI DSS compliance in Canada

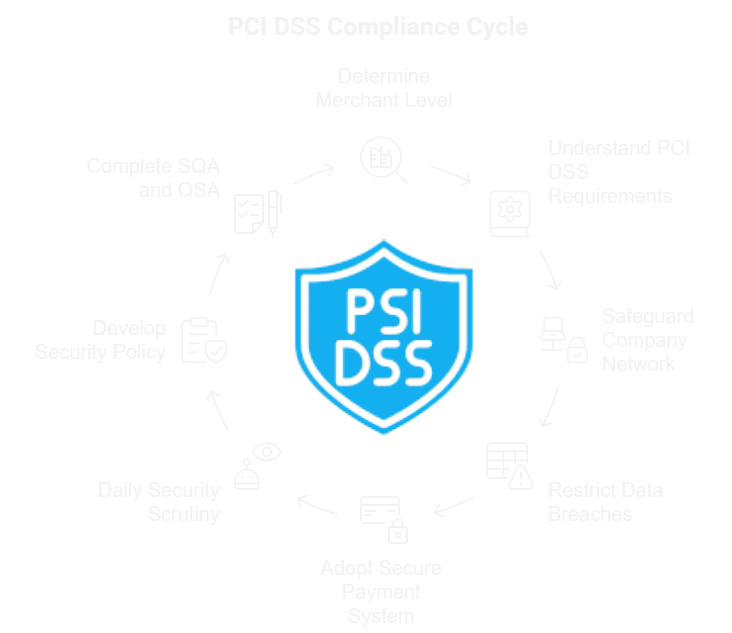

PCI DSS compliance is a significant security measure in Canadian companies. Not only does it protect the private data of consumers, but it also ensures that the company adheres to strict security mechanisms as mandated by the Payment Card Industry. A chronological analysis is available to help navigate the process of achieving PCI DSS.

Step 1: Determining merchant level – It is essential to determine the merchant level based on the number of transactions that the company processes annually. There are four levels of PCI DSS compliance in Canada, as mentioned previously, with significant separate compliance requirements.

Step 2: Understanding PCI DSS requirements – After determining the merchant level, it is crucial to ensure a custom that meets specific PCI DSS complaint requirements. This requirement involves continuing regular susceptibility monitoring, completing self-assessment analysis, and undergoing a yearly assessment by the Quality Security Assessor.

Step 3: Safeguarding the company network – To achieve PCI DSS compliance, it is essential to implement robust network security measures, including firewalls, regularly updating and patching the network system, and restricting access to cardholder data to authorised personnel involved in transactions.

Step 4: Restricting cardholder data breaches – Additionally, with PCI DSS complaints, organisations must ensure that all cardholder data is securely stored and transmitted. This also includes the encryption of data during transmission and after storing the cardholder information, which must be protected by using secure encryption methods.

Step 5: Adopting a secure payment system – While meeting PCI DSS requirements, it is essential to optimise only certified and secure payment systems to process credit card transactions, such as point-of-sale terminals and payment gateways.

Step 6: Daily scrutiny of the security system – Ensuring continuous monitoring and testing of the security network system is crucial for effective security measures. This involves conducting daily susceptibility scans, testing unauthorised data accessibility, and reviewing system logs for any malicious activity.

Step 7: Developing security policy – To achieve and maintain PCI DSS compliance, a mandatory security policy is compulsory, outlining the organisation’s security procedures, guidelines, and responsibilities for handling cardholder data.

Step 8: Completing the SQA and QSA – The self-assessment question is vital for businesses, as it helps assess compliance with the PCI DSS requirements and provides a structured analysis for a qualified security assessor to conduct a yearly assessment for merchants belonging to Level 1. This allows for a quick examination of the business system and processes to ensure compliance with the PCI DSS.

PCI DSS compliance is not a one-time system protocol investment; rather, it is a continuous process that should be updated along with daily modifications made by the service provider.

Cost of PCI Compliance in Canada

The cost of PCI certification can range from $1,000 to $10,000 per year, depending on your business size and number of transactions. While this may seem expensive, the cost of a data breach or losing the ability to process card payments is significantly higher.

Conclusion

In the rapidly evolving digital ecosystem in Canada, PCI DSS compliance has become a mandatory security protocol to protect payment card information. Organisations are aligning with the 12 core requirements of PCI DSS to minimise data leakage, improve customer trust, and avoid any kind of financial and legal constipation. Every Canadian business, from small startups to large companies, is complaining about the PCI DSS security protocol for processing payment card data. However, your business is required to strategise and strengthen its security compliance mechanism. In that case, investing in a PCI DSS-compliant service provider will make payment card transactions smoother and secure. Matayo offers AI-based solutions to help companies from various industries to streamline security processes and minimise risks. Partnership with Matayo will help Canadian organisations to upgrade their legal compliance protocol and build a crucial, resilient system.