The PCI DSS (Payment Card Industry Data Security Standard) certification is an international standard of security that aims to secure the information of payment cards and minimize the risks of data breaches and fraud development. The Cardholder data stored, processed, or transmitted by any Indian organization, including eCommerce sites, banks, fintech, and merchants, must adhere to the requirements of PCI DSS. This guide describes the meaning of the PCI DSS certification process of certification, and the associated costs.

What is PCI DSS Certification?

The certification of PCI DSS is necessary to show that your business is capable of operating sensitive cardholder data in a secure manner and up to the level required by the standards of the industry established by the PCI SSC. Your company should be in compliance at all times and in case you are taking credit cards through American Express, JCB International, VISA, and other brands, you should ensure that you check your compliance every year. The PCI DSS compliance is imposed on any company that gathers, processes, and transfers credit card information.

PCI DSS Requirements Explained

The core requirements of PCI DSS (Payment Card Industry Data Security Standard) are constructed on the basis of the principles that are predetermined to safeguard the personal information of cardholders and provide safe payment conditions. The explanation below provides a discussion on the most important PCI DSS requirements that all compliant organizations should adhere to.

● Build and Maintain Secure Networks

To safeguard the cardholder information, organizations would have to install and maintain secure network configurations. This involves the installation of firewalls to regulate both the incoming and outgoing traffic and unauthorized access to payment systems. Vendors must change default system passwords, settings, and security settings. The security of the network architecture is the main barrier against cyberattacks.

● Protect Cardholder Data

The sensitive information of cardholders should be secured in any location where it is stored, processed, or transmitted. PCI DSS mandates that card information should be highly encrypted, tokenized, or masked in order to avoid exposure. Sensitive authentication information, including CVV or PIN information, is forbidden to be stored following authorization. There should also be encryption protocols when transmitting data over public networks.

● Maintain a Vulnerability Management Program

Security weaknesses should be identified and dealt with through a strong vulnerability management program. Companies should employ newer antivirus and anti-malware software to ensure systems are not threatened. The operating systems, applications, and payment software should be patched on a regular basis to limit exposure to known vulnerabilities. There should be secure coding practices to avoid application-level attacks.

● Implement Strong Access Control Measures

Only need to know access should be allowed to the cardholder data. A separate ID should be given to each user in order to track and monitor access activities. Administrators and remote access should be implemented using multi-factor authentication. There should also be physical control of physical access to systems that store card data to ensure that they are not used or tampered with.

● Regularly Monitor and Test Networks

It will also require constant surveillance to identify suspicious behaviour and possible violations. Pseudonymization PCI DSS requires the tracing and recording of every access to network resources and cardholder data. Periodic vulnerability assessment and penetration testing should be carried out to measure the efficiency of security controls. These tests assist the organizations in actively detecting and addressing security vulnerabilities.

● Maintain an Information Security Policy

The firms should also develop and implement an overall information security policy that identifies the roles, responsibilities, and security measures. Security awareness training should be provided to the employees on a regular basis in order to minimize the risks of human error. The policy should be reviewed and revised periodically to deal with the changing threats, regulatory requirements, and business needs to maintain continued compliance with the PCI DSS.

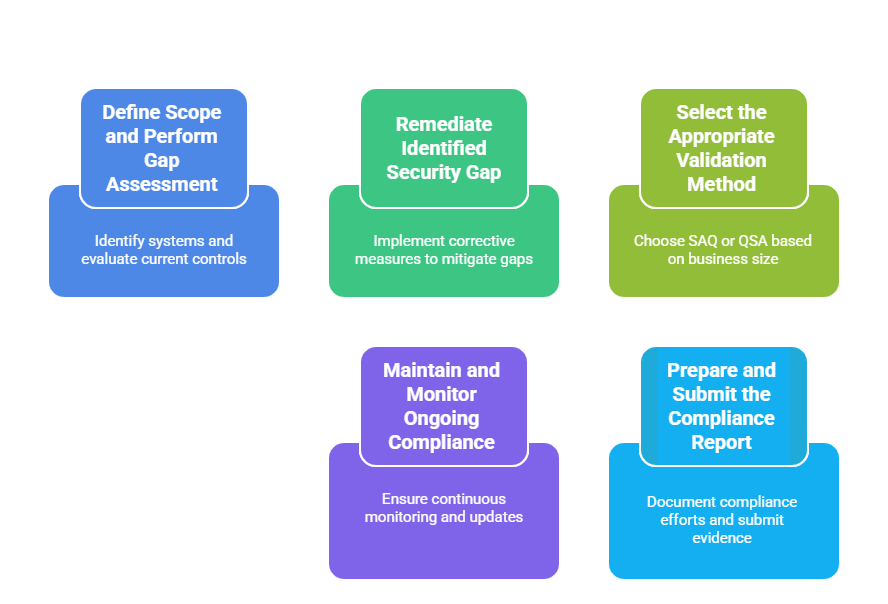

The PCI DSS Certification Process

Attaining PCI DSS (Payment Card Industry Data Security Standard) certification is a systematic process that assists organizations in risk identification, control measures, and also evidence compliance. The certification process in PCI DSS is explained below.

● Define Scope and Perform Gap Assessment

The initial one is to set the scope of PCI DSS compliance, which can be done by identifying systems, applications, networks, and third-party vendors that store, process, or transmit cardholder data. Evaluation of the gap is then followed to determine the current controls that are in place against the requirements of the PCI DSS. This analysis will serve to reveal vulnerable points, poor configurations, and missing policies that can reveal card data. Determinant scope avoids excessive compliance procedures and lowers the overall cost of certification.

● Remediate Identified Security Gap

After identifying the gaps, the organizations need to take corrective measures to mitigate them. This can include enhancing network security, implementing encryption solutions, enhancing access controls, or revising internal policies and procedures. Patching systems, fixing misconfigurations, and enhancing the ability to log and monitor are also considered vulnerable remediation. Remediation can be effective to ensure that security controls are in complete compliance with the standards of the PCI DSS before the process of validation is initiated.

● Select the Appropriate Validation Method

PCI DSS has provided varying validation procedures based on business and transaction volume. The smaller merchants have a possibility of completing a Self-Assessment Questionnaire (SAQ), but larger organizations or service providers will have to complete a formal audit by a Qualified Security Assessor (QSA). It is a significant decision to choose the right validation method because, in case of making the wrong report, non-compliance and punishment by the brands of payment cards may occur.

● Prepare and Submit the Compliance Report

Compliance efforts should be documented by the organizations after they have been remediated. This involves the accomplishment of the concerned SAQ or a Report on Compliance (RoC) by a QSA. The evidence to support this should include network diagrams, policies, vulnerability scan reports, and penetration test results, which must be gathered and provided to the acquiring banks or payment processors as needed.

● Maintain and Monitor Ongoing Compliance

The PCI DSS certification is not a one-time undertaking. To ensure that systems are monitored constantly, vulnerability scans are regularly performed, an annual assessment is conducted, and security controls are updated according to changes in threats. Organizations are to ensure that these tasks are performed. Continued compliance will provide long-term data security, mitigate breaches and security threats, and preserve customer, partner, and payment card brand trust.

Cost of PCI DSS Certification

The price of the PCI DSS certification varies for a number of reasons such as the size of the organization, its complex environment, and the area covered during the assessment. Now we shall get into the main elements of costs:

● Size of the Organization

Increased IT infrastructures are normally observed in larger organizations that process large amounts of cardholder data. This involves more comprehensive evaluations and improved security, which increases compliance expenses. One of the leading Indian e-commerce firms, having more than 1,000 staff members and a very good presence in the online sphere

Level of Compliance

The process of compliance is a continuous process with frequent evaluations, employee training, revising the system, and security testing. The four levels of compliance of PCI DSS, rating, are based on the volume of transactions:

- Level 1: More than 6 million transactions per year.

- Level 2: 1-6 million transactions per year.

- Level 3: 20,000 1 million transactions in a year.

- Level 4: Less than 20,000 transactions each year.

The better the compliance level, the stricter the requirements and, accordingly, the greater the costs.

● Hiring a Qualified Security Assessor (QSA)

QSAs are accredited individuals who assess the adherence of an organization to the standards

● Implementing Security Measures

To comply with the guidelines of PCI DSS, organizations might be required to invest in security solutions, hardware, and software. The cost of implementation may be between $15,000 and $25,000 and above depending on the requirements of the specific needs.

● Remediation Costs

Remediation costs include the expenses of repairing the gaps noted in the assessment. It can vary radically regarding network redesign, security tools (encryption, firewalls), segmentation, and policy development.

● Scanning and Tool Expenses

PCI DSS demands continuous security scanning and testing: Annual fees are required, and quarterly vulnerability scans with an Approved Scanning Vendor (ASV).

Costs are raised because of penetration testing and internal security tools (e.g., intrusion detection systems, SIEMs, and MFA).

Scanning and tooling may require tens of thousands to lakhs a year, depending on the number of systems in scope.

Conclusion

PCI DSS certification is important to businesses dealing with cardholder data, as it enhances security, minimizes fraud, and holds the customer’s confidence. Miscellaneous risks and unforeseen expenditures can be greatly minimized with the aid of proper planning, clear scoping, and regular compliance efforts. Through the attainment and the subsequent upkeep of the PCI DSS certification, companies not only comply with the requirements of payment safety throughout the globe, but also increase their popularity within the rapidly expanding Indian digital payment landscape and across the global. If you want to comply with PCI DSS certification, then contact Matayo and our presence in Canada and India. We provide end-to-end PCI DSS services, from gap assessment to ongoing compliance services, assisting businesses in obtaining certification efficiently, economically, and with confidence in a rapidly changing digital payment environment.